ACCOUNTING CURRENCY PER IFRS

Per IFRS (IAS 21) companies must keep their accounts in the “functional currency”. To determine it, first one should consider the following:

- the currency used to set (or link to) the sales prices or to receive sales proceeds

- the currency used to set (or link to) the purchase prices or to incur the direct expenses

Second, one should consider:

- the currency of borrowings or issued equity instruments

- the currency, in which the free cash is kept

Third, for subsidiary and associate companies one should also consider:

- the company operations autonomy degree from a controlling company or a group (whether the company just resells group products, or revenues and expenses are linked to or cash is kept and/or borrowed in local curency)

- the company operations share within the group

- the company dependency on controlling company cash subsidies, including availability of such cash proceeds on demand

- the sufficiency of own cash funds to serve credits and borrowings

Should the functional currency appear undeterminable with regard to the above indicators, it must be opted by the company’s management (still considering the indicators).

Herewith, the majority of IT companies, which receive sales proceeds in foreign currencies, at IFRS first adoption shall shift to an accounting in their major revenue currency.

HOW TO FILE FINANCIALS WITH TAX OFFICE AND STATISTICS?

In many countries, a in Cyprus e.g., the tax reporting is based on financial reporting, and the tax base is derived from the financial statements using central bank currency rates.

In Ukraine: According to Law “On accounting and financial reporting in Ukraine” (article 5) companies are obliged to maintained their bookkeeping in local currency. Whilst tax, statistical and other types of reporting are based on the bookkeeping data (article 3).

So, what is the solution?

COMPROMISE

IFRS permits to prepare the reporting in the presentation currency other than the functional currency. At the same time, IFRS prescribes the following currency translation algorithm (except for the hyperinflation case):

- assets and liabilities are translated at a closing currency rate

- financial results for the period (with few exceptions) – at a transactional currency rate

- respectively, any equity item is valued at a historical currency rate

- the difference between the above estimates is shown as an additional capital item, whereas its change for the period is presented in a comprehensive income statement (and not in a profits and loss statement)

The financial results could be valued using the most appropriate currency rate at the company’s discretion:

- actual transactional currency rate

- annual average currency rate

- periodic average (quarterly or monthly) transactional rate

Either the official Central Bank’s rate or a market currency exchange rates could be used.

Therefore, the concerned companies shall keep their records in the following way:

- each transaction must be revalued to a functional currency at a transactional rate (as if the local currency is a foreign one)

- the company shall ideally prepare 2 sets of financials: one presented to a local currency for governmental authorities, and another in a functional currency for investors and creditors

- when preparing the financials for the governmental authorities the accounting data in the functional currency shall be translated to the local currency using the currency rates as it is required by the IFRS

Note: further in this article I discuss only the financials prepared for the governmental authorities.

Multiple currency accounting may be easily achieved by an appropriate accounting system or ERP (e.g. SAP does it). And what should one do, if there is none? Or how to verify the correctness of such “double” accounting?

TWO CURRENCIES MODEL (EXAMPLE)

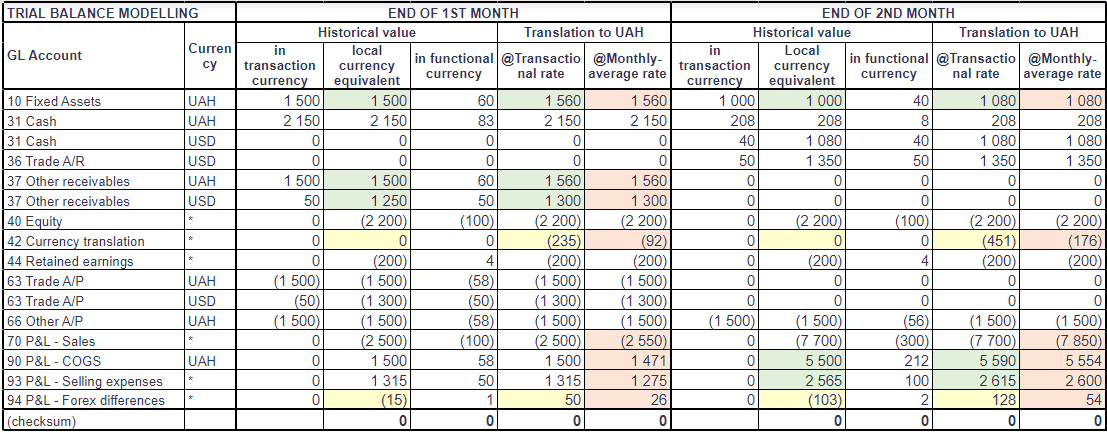

I compared the accounting entries of a virtual company using single currency and double currency accounting models (as if the USD is its functional currency). You may download the detailed analysis to dig deeper into details if you wish. I will at once move to the analysis results.

I did not even consider using the annual average currency rate, as the least appropriate in Ukrainian realities. From the remaining two, the monthly average rate has given huge variances on all P&L items. Since those variances might be hardly explainable during potential tax audits, I would not recommend using such method also.

The transactional currency rate translation method was the most approximate to a simple local currency accounting. The monetary items values remain the same, while the changes affect only:

- non-monetary balance sheet items (fixed assets, vendor prepayments etc.)

- period expenses (for the changes in depreciation and revaluation of vendor prepayments at invoice date)

- the forex differences in P&L only contain the forex market cash conversion profit and loss

- the resulting difference of the above items has sit in a new line “currency translation difference” in the additional capital (account 42 in Ukraine)

SOLUTION

Adjustment minimum

Hence, to maintain the functional currency accounting with further translation back to a local currency for the purposes of statutory reporting to the governmental authorities, a company must do at least the following:

1. Revalue the vendor advances in foreign currencies at a closing currency rate similarly to monetary items.

2. Separate accounting for the results of foreign currency sale-purchase conversion transactions. All other currency exchange differences should be transferred to a new “Currency translation” account within the additional capital (account 42 in Ukraine).

3. Maintain separate accounting register for fixed assets in the functional currency with further conversion of the asset movements to a local currency at transaction date (at monthly average for the depreciation). To post an additional accounting entry at the end of each month:

- DR(CR) Fixed assets – for the difference in the asset acquisition cost

- CR(DR) Accumulation D&A – for the difference in accumulated D&A

- DR(CR) NBV of disposed assets – for the difference in disposed (sold/written-off) assets

- DR(CR) Expense accounts – for the difference in D&A charge for the period

with a resulting amount posted to:

- CR(DR) Currency translation difference (additional capital)

UPDATE: The considered example is based on a model, when a company uses only two currencies: a local one and a foreign one (the functional one). If the a has other operational foreign currencies, it should reflect also the forex differences from cross-currency recalculations between each of such currencies and the functional currency (for the cross-rate fluctuation). The amount of each forex difference transaction should be split to two parts using factor analysis: 1) forex difference from a cross-rate change and from a functional currency rate change. The amount, which should rest in the forex difference in P&L will = (item functional currency equivalent amount at closing rate – item functional currency equivalent amount at original rate) * original functional currency rate. Similarly, the currency translation difference to be posted to additional capital will = item value in functional currency at closing rate * (closing functional currency rate – original functional currency rate).

Example: The company received cash of 100k EURO @rate 32, in total 3200k UAH. USD rate was 28. USD amount – 114k respectively. At period-close EURO rate is 30, USD rate is 26. USD amount has changed: 115k. So, as a result, the company should reflect:

– in P&L: (115k – 114k)*28 = 28k

– to equity: 115k * (26-28) = -230k

Other adjustments, if material

For the adjustments below it is necessary to assess first their materiality (depending on the account balances and turnovers, entry aging and expected currency rate fluctuation). Depending on the materiality one may decide: adjust monthly, quarterly, annualy, or not adjust at all.

4. Maintain accounting of vendor advances and other prepaid expenses in a local currency and a functional currency in parallel. To post the adjustting entries at the period end as follows:

- DR(CR) Vendor advances – and – DR(CR) Expense accounts

with a resulting amount posted to:

- CR(DR) Currency translation difference (in additional capital)

5. Maintain accounting of inventory and work-in-progress of all stages in two currencies in parallel similarly to vendor prepayments as described above.

Realization of this approach depends on circumstances of a particular company. It is obvious that if a company imports and sells goods within a cycle of longer than a month duration (surely, linking the sales prices and sales proceeds to a foreign currency) the rate fluctuation of above 1-2% could significantly impact the overall financial result of sales.

Idea for you: Wherever it is impossible (from a technical or human effort point of view) to maintain the inventory and WIP accounting using the currency rate at transactional level, a monthly average rate would work best, e.g.:

WIP (or expense element) movement for January:

– opening balance UAH 1000 @rate 24 or USD 41,67

– receipts UAH +5000 @monthly average 25,5 or USD 196,08

– outcomes UAH -4500 (or USD 178,93 – calculated)

– closing balance UAH 1500 @monthly average 25,5 (using FIFO) or USD 58,82

– the element revaluation will be (26-25,5)*58,82=UAH 29,41

TAXATION

Tax risks (for Ukraine)

So, the above adjustments will definitely entail the changes in the company’s financial results. Depending on the currency rate fluctuation the changes may be either way. What would be the authorities view about that?

The Tax Code of Ukraine directly stipulates that the taxable base is a financial result, and only the financial result (lines 2290 and 2295 of the income statement Form #2). The balance sheet items revaluations shown in other comprehensive income (section II of Form #2) shall not be count for the income tax purposes. The State Fiscal Service of Ukraine earlier issued explanatory letters in respect of similar situation, specifically – revaluation of financial instruments (e.g. this letter of SFS).

At the same time the discussion with the tax authority representatives and tax risks (of going to an appeal against unjustified tax accruals) could hardly be avoidable in Ukraine. However, at the same time such risks tend to be much lower having the independent auditor’s opinion about the financials in question confirming that the taxable financial result is correct.

Deferred taxes

The above adjustments may also lead to changes in deferred taxes, particularly in respect of currency translation effect for the balance sheet items. Meanwhile, the deferred tax changes shall also be partly posted against the mentioned additional capital line.

AUDITORS POSITIONS

We know that the Big4 auditors gathered a meeting on this topic. The majority votes for the IFRS standard approach.

However, regarding the complexity of the Ukrainian legislation the Big4 auditors pass through the issue during audits appealing to the fact, the currency choice is still us to the companies.