PROPOSED SOLUTION

To fill out a Tax Workbook following a specific methodology and algorithm (check-list). The Tax Workbook would be a data source for all of the above processes. This workbook also includes all the necessary source data and breakdowns, supporting tax calculations in case of an audit or a tax audit (hence, it is recommended to prepare the worksheets in a printable format). Adhering to the proposed methodology could allow to carry out tax calculations and reconciliations data at the first time. Methodology inaccuracies will be fully eliminated in about 2 reporting periods.

The Workbook is based on the tax accounting policies adopted by a company, and does not incorporate the accounting impact of potential tax risks. Although the Workbook is not intended for tax forecasting, using it during 1-2 completed periods would allow transferring its principles to any forecast or budget data.

The Workbook is filled in during each of the period closes: financial statements one and tax one. Each process data should correlate with each other (the estimated current income tax should the same). If a company prepares several reporting packages (corporate/group or management one, a stand-alone IFRS or a statutory one, interim or annual income tax return), a separate Tax Workbook should be prepared for each of the packages.

You can download the Tax Workbook template, a fill-in example and a checklist (which are available in 3 languages) via the link:

A BIT OF THEORY

The income tax calculation review and self-review methodology is taken from the best international auditing practices and is based on two complementary calculations:

- One, where the financial result is adjusted for the expected differences to get the taxable profit

- Second, when the taxable profit is adjusted for the missing differences to achieve the financial result before taxes

- The resulting calculations are then cross-checked, any discrepancies are clarified and eliminated

To compile the first calculation (from financial profit to taxable one), we will use the methodology provided by IAS 18 and NAS 17 (for Ukraine) “Income taxes”. Particularly, we will compare the nominal (as per the tax laws) and the effective (actual) income tax rates, prepare deferred tax calculations and explain permanent differences. A deferred tax calculation essentially serves as an explanation of temporary differences.

Permanent differences – incomes and expenses (profits or losses) that never impact taxable profits, or tax adjustments present solely in a taxable profit calculation with no analogue in financial accounting. In many countries, those are: representation and other non-deductible expenses under tax laws.

Temporary (or timing) differences – incomes and expenses (profits or losses) with which different recognition periods in financial accounting and tax returns. E.g. the differences in fixed assets depreciation methods, taxation rules for vendor or customer downpayments, doubtful and bad debt allowances and write-offs, income and expense estimates (provided per judgment of company management, and not based on transactions), tax losses carried forward to the subsequent reporting periods.

Let us consider few examples of permanent differences and their impact on reporting:

Non-deductible expenses

Let us suppose a financial profit of a company is $2,000. The company incurred representation and entertainment expenses of $500 disallowed for deduction in tax calculations. The tax rate is 20%.

Financial profit = (2,000), taxable profit = (2,500)

400 DR Income tax expense – expected estimate (20% of 2,000)

100 DR Income tax expense – effect of permanent differences (20% of 500)

(500) CR Current income tax A/P (20% of 2,500)

Effective tax rate: 25% (500 of 2,000)

Tax benefits

Let us suppose a financial profit of a company is $2,000. The company received on-purpose financing related to innovation projects in the amount of $500, which are tax-exempt. The tax rate is 20%.

Financial profit = (2,000), taxable profit = (1,500)

400 DR Income tax expense – expected estimate (20% of 2,000)

(100) CR Income tax expense – effect of permanent differences (20% of 500)

(300) CR Current income tax A/P (20% of 1,500)

Effective tax rate: 15% (300 to 2,000)

Let us also consider two basic examples of temporary differences and their impact on reporting:

Downpayments to suppliers

Let us suppose the tax legislation allows deducting downpayments to suppliers before actual receiving invoices / goods, works or services (i.e. incurring expenses). The financial company in the first period is $2,000, in the second – $3,000. The tax rate is 20%. In the first period, the company made a $1,000 prepayment to a supplier remaining on the balance sheet at the end of the period. Taxable income will be $ 1,000 lower than the financial result. In the next period, the downpayment will be cleared (invoices received), and the status will be nulled (taxable profit will be $1,000 higher than the financial result). Thus, in the first period, the company, having financial profit, receives a temporary tax credit, which has to be paid in the next period. The tax credit will be recognized in deferred tax liabilities.

Postings in the first period:

Financial profit = (2,000), taxable profit = (1,000)

400 DR Income tax expense (20% of 2,000)

(200) CR Deferred tax liabilities (20% of 1,000)

(200) CR Current income tax A/P (20% of 1,000)

Postings in the second period:

Financial profit = (3,000), taxable profit = (4,000)

600 DR Income tax expense (20% of 3,000)

200 DR Deferred tax liabilities (20% of 1,000)

(800) CR Current income tax A/P (20% of 4,000)

Advances from customers

Let us suppose the tax legislation requires that the downpayments (advances) from customers included to the taxable income prior shipment of goods, works or services. Let the initial data be the same as in the example above. In the first period, the company received $1,000 of customer downpayments remaining on the balance sheet at the end of the period. The taxable income will be $1,000 higher than the financial result. In the next period, the downpayment will be cleared, and the situation will be nulled: the taxable profit will be $1,000 lower than the financial result. Thus, in the first period, the company, not yet having a financial profit, will pay tax in advance and credit it in the subsequent period. This prepayment will be recognized in deferred tax assets.

Postings in the first period:

Financial profit = (2,000), taxable profit = (3,000)

400 DR Income tax expense (20% of 2,000)

200 DR Deferred tax assets (20% of 1,000)

(600) CR Current income tax A/P (20% of 3,000)

Postings in the second period:

Financial profit = (3,000), taxable profit = (2,000)

600 DR Income tax expense (20% of 3,000)

(200) CR Deferred tax liabilities for income tax (20% of 1,000)

(400) CR Current income tax A/P (20% of 2,000)

Temporary items do not affect income tax expense, which always remains “normalized” in respect of the financial result. Because of deferred tax accounting the financial profit before tax is always accompanied with the economically justified income tax expense.

Summarizing, the above examples demonstrate that it is possible to determine the taxable profit and income tax amounts having (understanding) only the data about temporary and permanent differences and deferred taxes (we will call such approach “Method No. 1”).

Calculation of deferred tax assets and liabilities (DTA / DTL)

Temporary differences may be most easily identified by a detailed analysis of the company’s balance sheet items for whether there are any differences between the tax and financial accounting income or expense recognition principles. For that a “tax balance” (or “tax base” of assets and liabilities) is built in parallel, and a comparison of two balance sheets is made. It is easy to determine which item (DTA or DTL) arises on a particular balance sheet item if you present assets and liabilities using a single approach for the numeric signs: assets with “plus”, liabilities with “minus”, financial carrying value on the left, tax base on the right, temporary base difference would be = tax base – financial base, temporary difference with plus will be DTA, with minus – DTL. For example:

FCV | TaxB | Diff | DTA/L | Comments |

100 | 100 | – | – | There is no difference on the asset item |

(100) | (100) | – | – | There is no difference on the liability item* |

100 | – | (100) | ОНО | Vendor downpayment without VAT, deducted for tax |

100 | 17 | (83) | ОНО | Vendor downpayment with 20% VAT, deducted for tax |

(100) | – | 100 | ОНА | Customer downpayment without VAT, taxable at receipt |

(100) | (17) | 83 | ОНА | Customer downpayment with 20% VAT, taxable at receipt |

100 | 120 | 20 | ОНА | Accumulated depreciation (fixed assets carrying value) difference |

– | 100 | 100 | ОНА | Tax losses carried forward to future periods |

Such system of signs is used throughout the Workbook and among other things it helps to avoid errors of data entry with a wrong sign.

Temporary differences are pre-tax items, thus, they do not arise on capital and retained earnings lines.

CALCULATION OF PROFITS TAX PER TAX CODE OF UKRAINE

The Workbook example is based on a real Ukrainian company data for 2018. The Ukrainian rules for income tax calculation have the following specifics:

- The income tax calculation (return) is already based a “Financial Result + Differences” concept (we will call it “Method No. 2”). This method is certainly convenient, but cannot provide enough assurance about the income tax correctness, and that´s why we will still use Method No.1 simultaneously.

- In 90% of cases, an average commercial or industrial Ukrainian company will have a quite limited list of tax differences, most likely including:

Temporary differences

- differences in depreciation methods for fixed and intangible assets (depreciation amounts and residual values of disposed items)

- differences related to doubtful and bad debts allowances (only the debts actually written-off and satisfying certain criteria (90% of cases) are allowed for tax deduction)

- differences related to accounting for provisions for future expenses (the most controversial type of differences according to the Tax Code, which deserves a separate article of mine)…

Below, based on the Workbook example, we will discuss some aspects of practical application of these tax rules.

Permanent differences

- amounts transferred to non-profit organizations below the allowed tax limit

- fines, penalties and interest paid in favor of non- income tax payers (e.g. non-residents)

PREREQUISITES OF USING THE WORKBOOK

In order to use the Workbook effectively the following prerequisites should be created:

- Closing the period should be carried out in two stages:

- After completing all financial entries (adjustments) for the period (the document template is based on the “fast close” on the 2nd day after month-end), one should calculate and post income tax provisions

- The factual income tax return accrual will be posted after its submission. It is not expected that the company will have to make adjustments to financial statements related to the revised tax accruals, as the differences should be insignificant.

The high-level workflow diagram for the above two processes (also attached to the Workbook) looks like this:

In this regard, as well as in order to identify and eliminate even small errors, one should maintain separate accounts or subaccounts for:

- current income tax expense for the current period

- current income tax expense for previous periods (for corrections)

- deferred income tax expense for the current period

- deferred income tax expense for previous periods (for corrections)

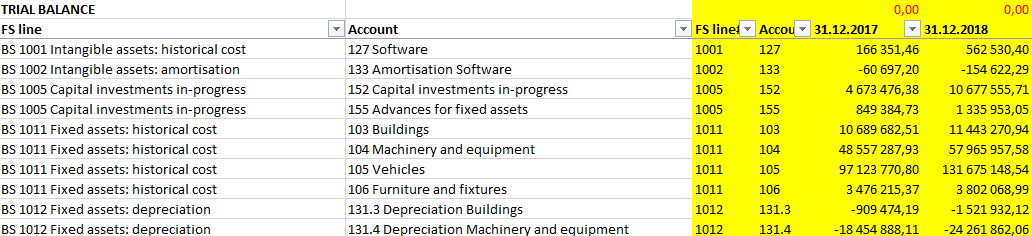

- To fill in the Workbook it is necessary to get a trial balance from the accounting system — a list of all accounts with balances at the beginning and end of the reporting period. It is advisable that the trial balance is mapped to the financial statement lines (since the same account may be included into different lines). In order to reduce the processing time, it is recommended to use a single pre-configured trial balance format for financial statements compilation and the Workbook.

- Items with temporary differences should be on separate balance sheet accounts. In particular, for all types of tax-relevant provisions. Provision entries should correspond with income and expense accounts only (following “accrual (increase) – reverse (decrease)” approach). The utilization transactions should not be posted to the provision accounts, but directly to the income and expense accounts. For example:

For doubtful and bad debts the following accounts should be created:

CR Allowance for doubtful debts (balance sheet)

DR Increase in the allowance for doubtful debts (P&L)

CR Decrease in the allowance for doubtful debts (P&L)

DR Write-off of bad debts (P&L)

Accounts for non-tax-deductible provisions should be posted as follows:

Accrual: DR Expense accounts CR Provisions (non-tax)

Closing: a reversal of the above + actual invoices to DR Expense accounts

- The tax-relevant provision accounts should allow detailed account analytics for further analysis during the tax return preparation and checking

- For Ukraine: some simplifications are made when filling in the income tax return, which we will discuss a bit later.

ATTENTION! The considered methodology contains one significant limitation: if a company creates non-tax-deductible provisions debited to the inventory (work-in-progress or finished goods) accounts with some balance at period-end, the respective balances inside such lines will not be taken into account (taxable profit will be artificially overstated by the amount of such provision for the first period, and later artificially understated for the same amount in the subsequent tax period). The reason being this is a quite time- and resource- consuming exercise, as well as such calculation would be rather unique for each company.

The proposed Workbook template also includes a detailed checklist to be followed as a part of the closing processes mentioned above.

WORKING WITH THE TAX WORKBOOK

It is quite simple: for the first time one should fill in all the sheets from TB to RET sequentially. Working papers are highlighted in green, without highlighting – auxiliary lists and documents (particularly statutory reporting forms serving as the basis for the tax return). The sheets from TB to CIT are filled in during the period-close, and the sheets from FS to RET are used only during compilation of the tax return.

The filled-in fields are usually marked with yellow.

Sheets TB, CoA and FS

TB – is a trial balance downloaded from the accounting system in the format and with signs as described above, which is formed after period-close (all postings and adjustments for the period). It is advisable to have it mapped to the financial statement lines.

One should make sure that the total of the trial balance equals to 0 (the top line contains a checksum in red).

In the first two columns the document automatically pulls up the account names and financial statement lines from the sheets CoA and FS. If a new account or a new reporting line is discovered, they should be added to those lists. While adding a new account, it should be also included to the deferred tax calculation sheet DT. If there is a temporary difference associated with this account, one would need to return to its analysis during filling out the DT sheet (mark the account with a special color for your convenience).

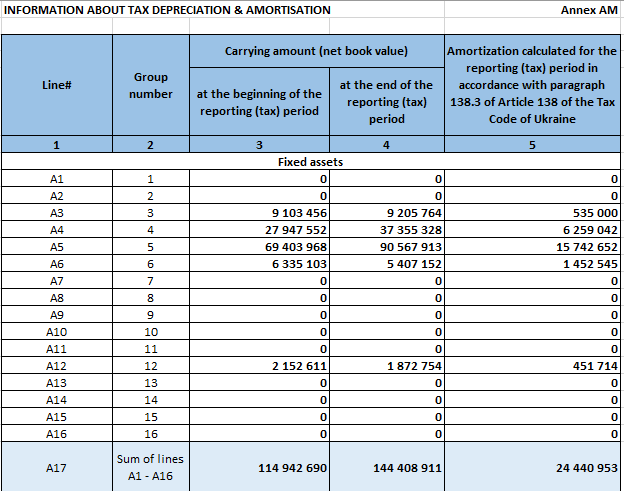

Sheets AM and FXA

This is fixed assets movement data and a calculation of the fixed assets temporary difference between financial and tax accounting. The data should be generated by an asset accountant as early as possible. For example, in the case of a period fast-close on the 2nd working day of the next month, all asset transactions should be completed by (minus)2nd working day prior the month-end, and such reports should be prepared and checked by (minus)1st working day (or even earlier).

The sheet AM, which is an auxiliary one, contains summary information on the fixed assets in tax accounting, in a format required for the tax return (Appendix AM for Ukraine in 2018). This summary information should be accompanied with supporting detailed statements / accounting system data downloads.

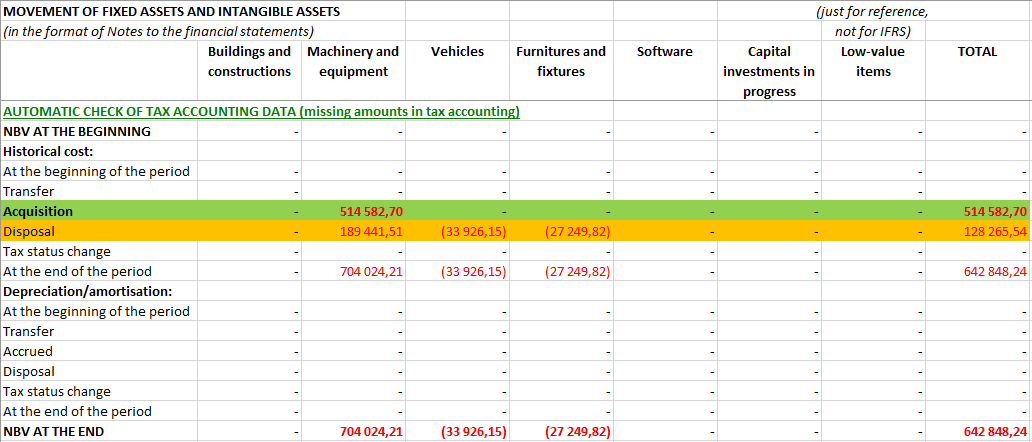

The sheet FXA incorporates a report on the fixed assets movement of financial accounting. The report contains the summary data from a separate file with all supporting data prepared by the asset accountant. To reduce the time to prepare various fixed assets reports, it is recommended to compile this report in a format required for the fixed asset movement note to the financial statements (by respective asset classes), as it is in the Workbook:

In a similar format (separate blocks on the same sheet below) and using similar fixed asset classes (which may be different from the classed used for tax accounting), it is necessary also to provide the data regarding:

- items, which depreciation is not tax-deductible (so-called “non-production” fixed assets, including the capital investment items not yet put into operation in tax accounting)

- fixed assets tax accounting data

Moreover, the template provides separate lines to include the values of items transferred between the groups (“Status change” line).

In result of filling-in all the required data, the template will automatically reconcile data on fixed assets movement between financial and tax accounting, which would allow to prevent potential errors. In the considered example, the template revealed UAH 515k of assets “lost” (not put into operation) in tax accounting (resulting to additional tax expense), and also a potential mistake in the tax accounting data on the fixed assets disposal:

The additional analysis clarified that the asset disposal discrepancy did not lead to errors in financial statements or tax expenses. However, the discrepancy in new items acquisition amounts (marked green) should be corrected in the next period.

As you may notice, the template includes the data on intangible assets, capital investments-in-progress and low-value items. The latter two may be required in the following cases:

- Using different capitalization dates in financial and tax accounting, and, therefore, the tax status of each capital investment item is also monitored at the reporting date

- Applying different fixed asset capitalization thresholds in financial accounting and as per tax rules. Particularly, in our case, the company used asset capitalization threshold of UAH 8,000, while the Ukrainian tax legislation provides only for UAH 6,000. The items with the cost from UAH 6,000 to 8,000 are written off to expenses at acquisition date (monthly 100% cost depreciation method), but in the tax accounting such items are depreciated following standard tax rules (as a part of fixed assets groups). Such accounting policy generates additional temporary differences.

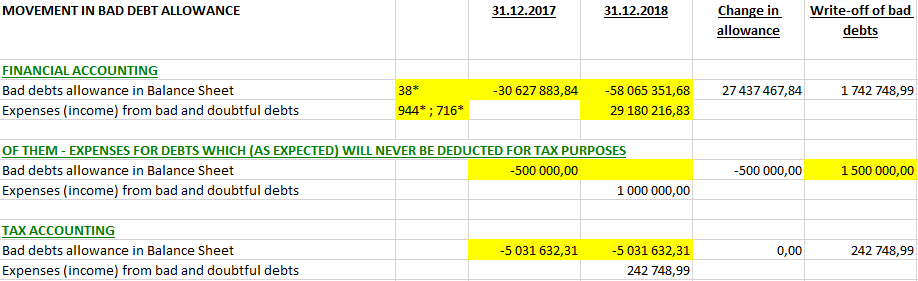

Sheet BDP

On this sheet, we perform a reconciliation of a bad debt write-off financial result with a doubtful debts allowance movement, as well calculating and analyzing the tax-deductible expenses in this regard. A similar methodology could be applied to analyze other types of asset and liabilities valuation allowances, if it is required according to the tax legislation and accounting policies of a company (for example, inventory valuation provisions).

The financial accounting data is pulled up directly from the trial balance data.

The second section includes doubtful and bad debt allowances, which are not expected to affect the taxable profits in the future due to the tax legislation restrictions. In our case, the company had UAH 500k of such debts at the beginning of the period, which were provided in the books, but are not allowed for tax deduction. This debt was written off in the reporting year, including similar debts in the amount of UAH 1,000k (expensed in the reporting period). This amount represents the permanent difference for the reporting period.

Based on the first two sections, the third one automatically calculates the tax accounting data. The fields “Doubtful debt allowance in balance sheet” includes the debts, which the company has already recognized as deductible expenses prior the reporting period or decides to recognize as such in the current period. In our specific example, the company included the doubtful amounts of the debtors suffering the bankruptcy proceedings, which had been recognized as deductible expenses in 2011 under Article 12 of the old Law “On Enterprise Profits Tax in Ukraine” (following to the transitional provisions of the Tax Code of Ukraine).

Similarly to all other sheets, all the source data used in this sheet should be attached to (or provided in separate files) the Workbook (for example, statements of movement on doubtful debt accounts with their tax status marked).

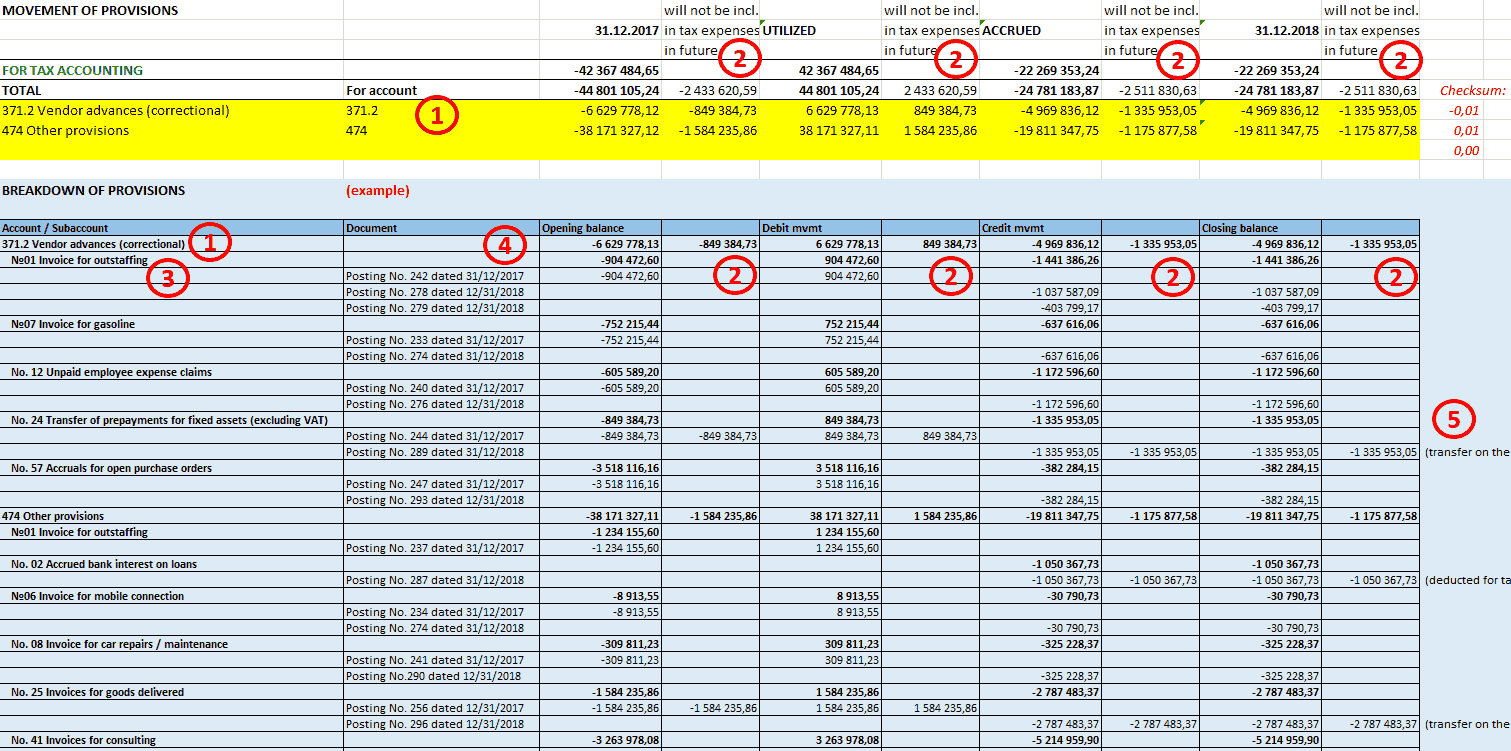

Sheet PRV

This is a breakdown of non-tax relevant provisions (which will be deducted in tax accounting only when invoiced). The sheet also includes an example of a data source statement. The methodology may be used for other types of provisions as it is required to comply with the tax legislation and according to the accounting policies of a company (for example, provisions for customer discounts and deferred revenues).

Here are some explanations how to fill:

( 1 )

The analysis should include all tax-relevant provision accounts, and there may be quite a lot of them. A company should analyze all the accounts with the purpose whether to the change the approach, and all the exceptions should be covered by the company’s internal accounting policy.

For Ukraine: for better tax compliance, it is recommended that all the tax-relevant differences are accounted using separate subaccounts of provision account (#47 according to the national chart of accounts in Ukraine). In our example, this was subaccount 474. Ideally, companies should ensure comparability of provisions data between tax returns and provision-related notes to their financial statements.

In our example, the company, in accordance with the tax law and its accounting policy, did not include the following accounts in the analysis:

- personnel vacation pay and bonus provisions

- accruals on customer discounts, including loyalty bonuses

- accruals on intercompany invoices for royalty

- inventory provisions

However, the company included an account for provision related to vendor prepayments (subaccount 371.2) created according to IFRS, since the company decided not to deduct such expenses in tax accounting.

( 2 )

For each subaccount and for each provision type one should perform a detailed analysis for whether the respective amount affect tax expenses in the future or not. The not-affecting amounts are excluded from the provision movement and affect the deferred tax calculation. These amounts include:

- costs included to the assets acquisition values and not yet expensed (in our example, those are missing goods purchase-related vendor invoices (accruals) and vendor prepayment transfer to capital investments)

- provisions allowed for deduction in tax accounting (in our example, that was the accrued interest on a bank loan)

- expenses that are not allowed for deduction for tax purposes

Any unusual transaction would require special attention: in our example, there was a supplier’s credit note posted to a provision balance, which was decided to take in tax accounting immediately in the reporting period (however, before the agreement with the supplier is reached and the credit note is actually received).

( 3 )

It is recomended to prepare detailed provision analytics. In our example, the company (having a “fast close”) controls the month-close entries using a list (closing manual entries described and numbered in a month-close schedule), which is an effective control example over the financial statements preparation. Here is a sample of the closing adjustments the company has:

No. 01 Invoice for outstaffing

No. 02 Accrued bank interest on loans

No. 06 Invoice for mobile connection

No. 07 Invoice for gasoline

No. 08 Invoice for car repairs / maintenance

No. 12 Unpaid employee expense claims

No. 24 Transfer of prepayments for fixed assets (excluding VAT)

No. 25 Invoices for goods delivered

No. 41 Invoices for consulting

No. 42 Invoices for legal services

No. 49 Provision for audit

No. 57 Accruals for open purchase orders

No. 74 VAT provision on sales below cost

No. 75 VAT on inventory provision

No. 76 Documents of suppliers received after B/S date (cut-off)

In our example the company follows an approach that all the accrued costs (without suppliers invoices) are first posted as a provision, but later transferred to vendor accounts (adjustment No. 76) during the statutory month-close upon the receipt of vendor invoices.

( 4 )

The available information about the accounting entry date helps to control the duplicate or unreversed accounting postings. This is another basic control of the effective month-close.

( 5 )

Working papers should provide sufficient commentaries helping understand certain accounting judgements. It is recommended to form any supporting sheets and comments immediately in a format suitable for printing and providing to external auditors and tax auditors.

( 6 )

To avoid errors in formulas and breakdowns, all the source and summary data should be checked against each other, as well as reconciled with the trial balance.

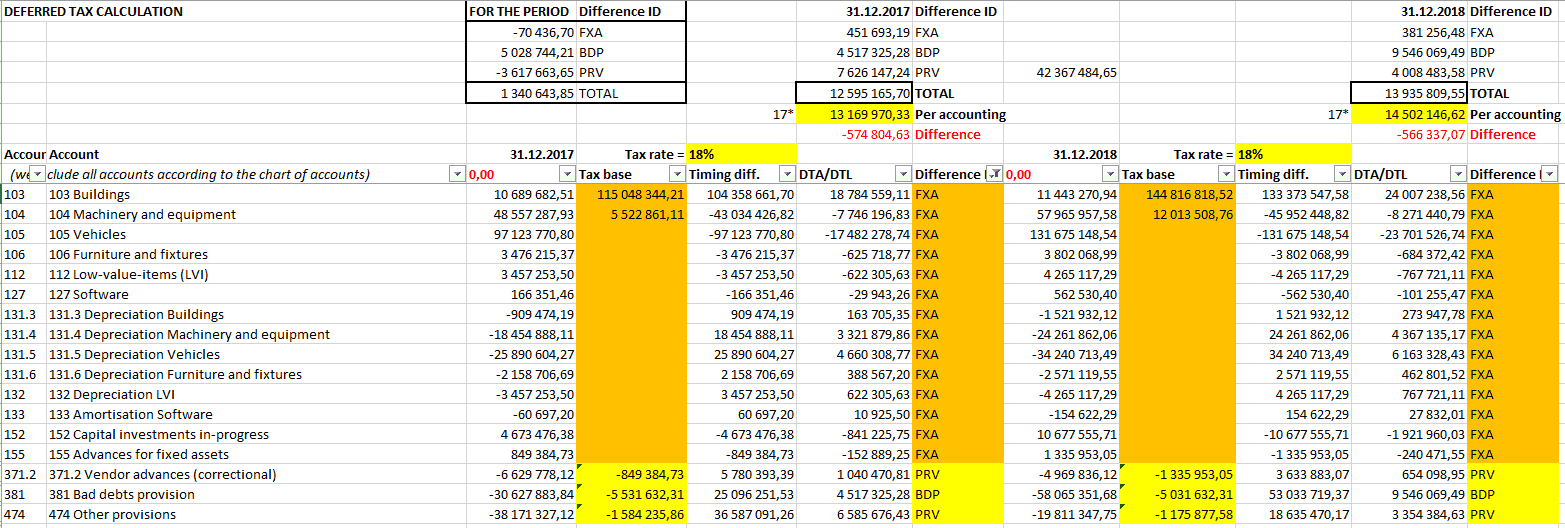

Sheet DT

On this sheet the deferred taxes are automatically calculated for two reporting dates (the beginning and the end of the reporting period) according to the principles described above and on the basis of already analyzed temporary differences data. The worksheet require just adding missing accounts and copying the formulas, and the trial balance data is pulled out automatically. This allows to use a single template from period to period, rather than compile a new calculation each time.

The calculation analyzes the temporary difference amounts and the deferred tax asset / liability balances as at a reporting date, as well as their movements for the reporting period.

As you may see, the tax bases comprise:

- for fixed and intangible assets – the asset net book value for tax accounting (future expected costs from their use) + net book value of assets, which are yet depreciated in tax accounting (as there is no temporary difference on them)

- for doubtful debts allowance – the value of debts recognized as deductible expenses in tax accounting in the periods preceding a balance sheet date, as well as the amount of debts that will never be deducted (as the temporary differences do not arise)

- for provisions – the provisions amounts that either were deducted as expenses in tax accounting (or recognized as taxable income) or will never be deducted even after the invoices have arrived (similarly, since there are no temporary differences arising)

Based on the calculated temporary differences the deferred tax asset / liability balance (DTA / DTL) is calculated, compared with the balance on a respective account, and the necessary adjustment is calculated to bring the DTA / DTL balances in line with the calculation.

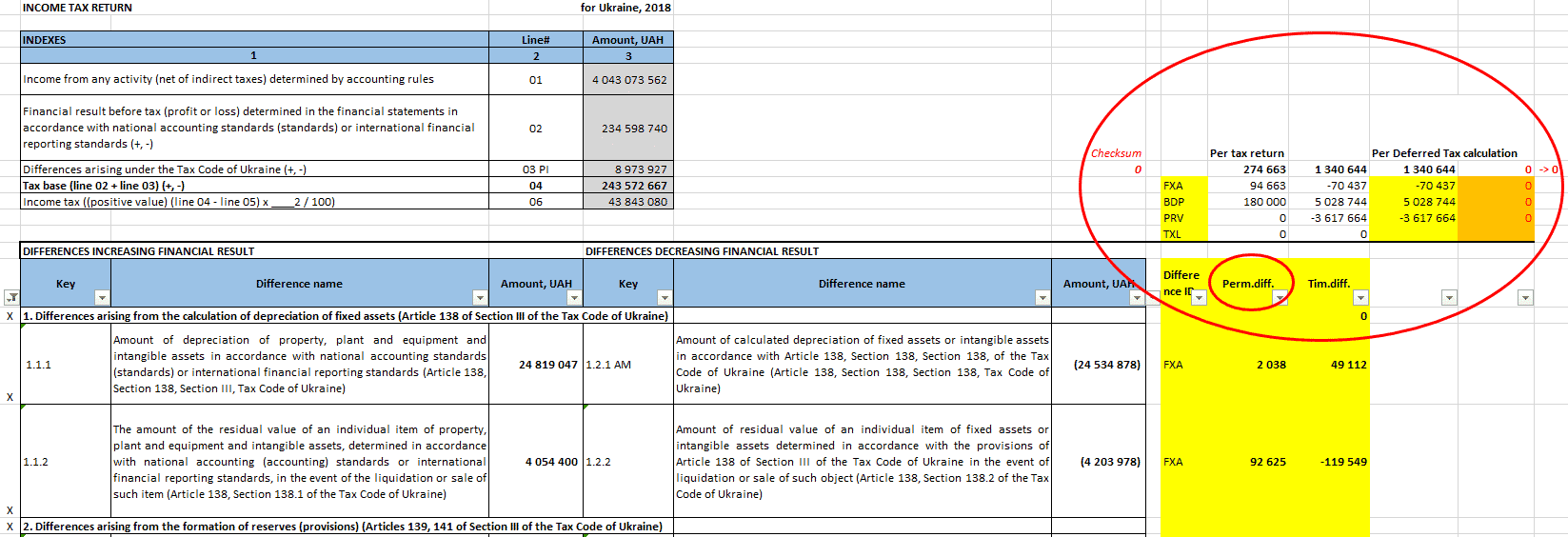

Sheet CIT

On this sheet (following all the same conceptual principles as we described above) we calculate the required current income tax provision and summarize on which current and deferred tax postings as at the balance sheet date are required.

As the temporary differences have already been analyzed in detail, this calculation includes a detailed analysis of permanent differences. Thus, earlier we discovered the following ones:

- unexplained difference on fixed assets movement, which requires a more thorough re-examination (presumably, it is about missing fixed assets acquisition records in tax accounting)

- depreciation of non-production fixed assets (which depreciation is not allowed for tax purposes)

- write-off costs on bad debts that do not meet the tax criteria

Here we also add some new manual entries (yellow fields) that might be known from the past tax return compilation experience, as well as based on knowledge and understanding of new transactions, tax and accounting changes for the period, e.g.:

- charity expenses above the allowed tax threshold

- fines, penalties and interest disallowed for tax deduction

The additional entries should be accompanied by and linked to source data.

As a result, we will receive a periodic income tax accrual estimate (tax return accrual) for the reporting period, as well as the confirmed period-close income tax expense entries (highlighted in red). In our example, those are:

- 574,804.63 DR 982.2 Deferred income tax (previous years)

- (8,467.56) CR 982.1 Deferred income tax (current year)

- (566,337.07) CR 170 Deferred tax assets

- 1,106,049.85 DR 981.1 Current income tax (current year)

- (1,106,049.85) CR 641.26 Income tax provision

Note: the income tax provision posting will be correct only provided that the income tax settlements account (tax authorities AP/AR) balance at the beginning of the period is correct. One should also remember that the income tax-related fines, penalties and interests according to IFRS (and NAS respectively) are also reflected as income tax expenses and would comprise the additional permanent differences.

After making the calculations above and posting the identified tax entries, the financial period will be completely closed. The data on the DT and CIT sheets may serve as the completed income tax Notes to the company financial statements. As the calculations take less than a day, getting preliminary income tax estimates depends entirely on financial month-close timings. At the subsequent stage (having some spare time) the finance staff may focus on preparation and more thorough checking of the tax return.

The subsequent sheets of the Workbook are applicable to Ukraine only. For other countries the methodology should be adapted in a similar way.

Sheets BS, IS, FS

The sheet FS is a list of financial reporting lines, and the sheets BS and IS incorporate the automatically generated financial reporting forms provided that the trial balance ( sheet TB ) is mapped to the reporting lines. This allows to verify that the reporting forms submitted to tax authorities previously correspond to the calculations source data (otherwise, the correctional financial statements might need to be resubmitted to tax authorities).

Sheet RET

This is a tax return form for Ukraine. All the previously gathered and analyzed source data is already linked to this form, so it is a nearly ready tax return to be submitted, which remains only to be checked once again in terms of the source data relevancy and omissions.

The tax return draft contains few technical simplifications compared to the tax legislation rules:

- the provision reversal (or beginning balance) is put to line 2.2.1 of the Annex PI (line 2.2.1.1 may also be used instead), and the provision accrual (or closing balance) is inserted to line 2.1.1

- the doubtful debts allowance increase / decrease is shown in lines 2.1.2 or 2.2.2 respectively, the total bad debts write-off amount is shown in line 2.1.3 and the deductible bad debt amount – in line 2.2.3

Although such simplifications, from a certain standpoint, might not be fully methodologically correct, they have no impact on the tax accrual calculation and there no penalties for such a change.

Having drawn up the tax return, one should check (marked yellow on the right) that the temporary and the permanent differences per the tax return and Method No. 1 ( per sheets DT and CIT ) match.

Having already all the supporting source data, the tax or finance manager will be able to check the resulting tax calculation in less than 1 hour.

Once again, the attached below is the link to the Workbook, including the described templates with an example (in 3 languages) and a checklist of the internal finance process together with the workflow diagrams.